Stablecoins have quietly become a tour de force in the global cryptocurrency market, representing more than two-thirds of the trillions of dollars worth of cryptocurrency transactions recorded in recent months.

Unlike most cryptocurrencies, which can often be subject to dramatic price swings, stablecoins are pegged 1:1 to less volatile assets such as fiat currencies or commodities in order to maintain a consistent, predictable value.

Globally, stablecoins are gaining momentum as both a medium of exchange and a store of value, addressing gaps left by traditional currencies — particularly in regions with monetary instability and/or limited access to the U.S. dollar (USD). Businesses, financial institutions (FIs), and individuals are leveraging stablecoins for use cases ranging from international payments, to liquidity management, to protection against currency fluctuations. The ability to facilitate swifter, more cost-effective transactions compared to those of traditional financial systems has accelerated the adoption of stablecoins across the world.

As regulatory momentum surrounding cryptocurrency continues to gain headway, stablecoins are becoming a focal point in discussions examining the technologies shaping the future of finance.

What is a stablecoin?

Stablecoins are programmable digital currencies, most commonly pegged 1:1 to fiat currencies like the USD. Primarily issued on networks like Ethereum and Tron, stablecoins have combined the power of blockchain technology with the financial stability necessary for practical use cases of cryptocurrencies.

In 2009, the launch of Bitcoin revolutionized the financial infrastructure of the world by introducing a decentralized, peer-to-peer transaction system that eliminated the need for intermediaries. However, its limited supply and speculative trading dynamics resulted in extreme price volatility, making its native token bitcoin (BTC) challenging to use as a medium of exchange. Similarly, when Ethereum emerged a few years later, it built upon Bitcoin’s foundation, expanding the capabilities of cryptocurrencies to programmability with smart contracts. This innovation spurred the rise of decentralized finance (DeFi), but like bitcoin, Ethereum’s native token Ether (ETH) also suffered from significant price volatility.

Stablecoins, which first appeared in 2014 combines the technological benefits of blockchain — such as transparency, efficiency, and programmability — with the financial stability needed for widespread adoption. By solving the issue of crypto price volatility, stablecoins have unlocked new use cases beyond trading and speculation, appealing to a broad range of crypto users, both retail and institutional.

Types of stablecoins

Stablecoins maintain their value through various mechanisms designed to ensure price stability.

Fiat-pegged stablecoins

Fiat-pegged stablecoins — by far the most popular type of stablecoin — are tied 1:1 to the value of traditional currencies, with the USD and euro (EUR) being the most common benchmarks. These stablecoins derive their stability from reserves held in fiat currency or equivalent assets, which act as collateral. Examples include the USD-pegged Tether (USDT) and USD Coin (USDC) and EUR-pegged Stasis Euro (EURS).

Commodity-pegged stablecoins

Commodity-backed stablecoins are tied to the value of physical assets like gold, silver, or other tangible commodities. These stablecoins offer users the ability to gain exposure to commodities without directly owning them. For example, PAX Gold (PAXG) is a stablecoin backed by gold reserves, where each token represents one troy ounce of gold stored in a secure vault. Another example is Tether Gold (XAUT), which similarly provides gold-backed stability.

Crypto-backed stablecoins

Crypto-backed stablecoins are backed by reserves of other cryptocurrencies. These stablecoins often use overcollateralization — meaning that the value of assets held in reserves is greater than the pegged value — to mitigate the inherent volatility of their underlying assets. For instance, Dai (DAI) is backed by cryptocurrencies such as ETH and maintained through a system of smart contracts within the MakerDAO protocol. Users deposit collateral to mint Dai, ensuring its stability despite fluctuations in the collateralized cryptocurrencies.

U.S. Treasury-backed stablecoins

U.S. Treasury-backed stablecoins such as Ondo’s USDY and Hashnote’s USYC are different from traditional fiat backed stablecoins that are backed by cash reserves or liquid assets. Supported by U.S. treasuries and repurchase agreements, they offer yield directly to holders essentially functioning as tokenized money market funds and appealing to investors seeking secure, passive income with regulatory alignment.

Algorithmic stablecoins

Algorithmic stablecoins maintain their value through programmed mechanisms that adjust supply based on market demand, without relying on direct collateral. Examples of algorithmic stablecoins include Ampleforth (AMPL), which adjusts its supply dynamically to stabilize price, and Frax (FRAX), a partially algorithmic stablecoin that combines collateralization with algorithmic adjustments. Ethena’s USDe, a synthetic USD-pegged stablecoin, uses crypto assets and automated hedging to maintain its dollar value without directly holding fiat currency. While these models are innovative, they face challenges in maintaining long-term stability, as seen with the collapse of TerraUSD (UST) in 2022, highlighting risks associated with purely algorithmic stabilizing mechanisms.

Stablecoins in the crypto market

Outside of the arena of speculation, stablecoins play an essential role in the cryptocurrency market by providing a reliable medium of exchange, a store of value, and a bridge between TradFi and crypto. As a critical liquidity provider, stablecoins underpin much of the activity within decentralized finance (DeFi), centralized exchanges (CEXs), and cross-border payments.

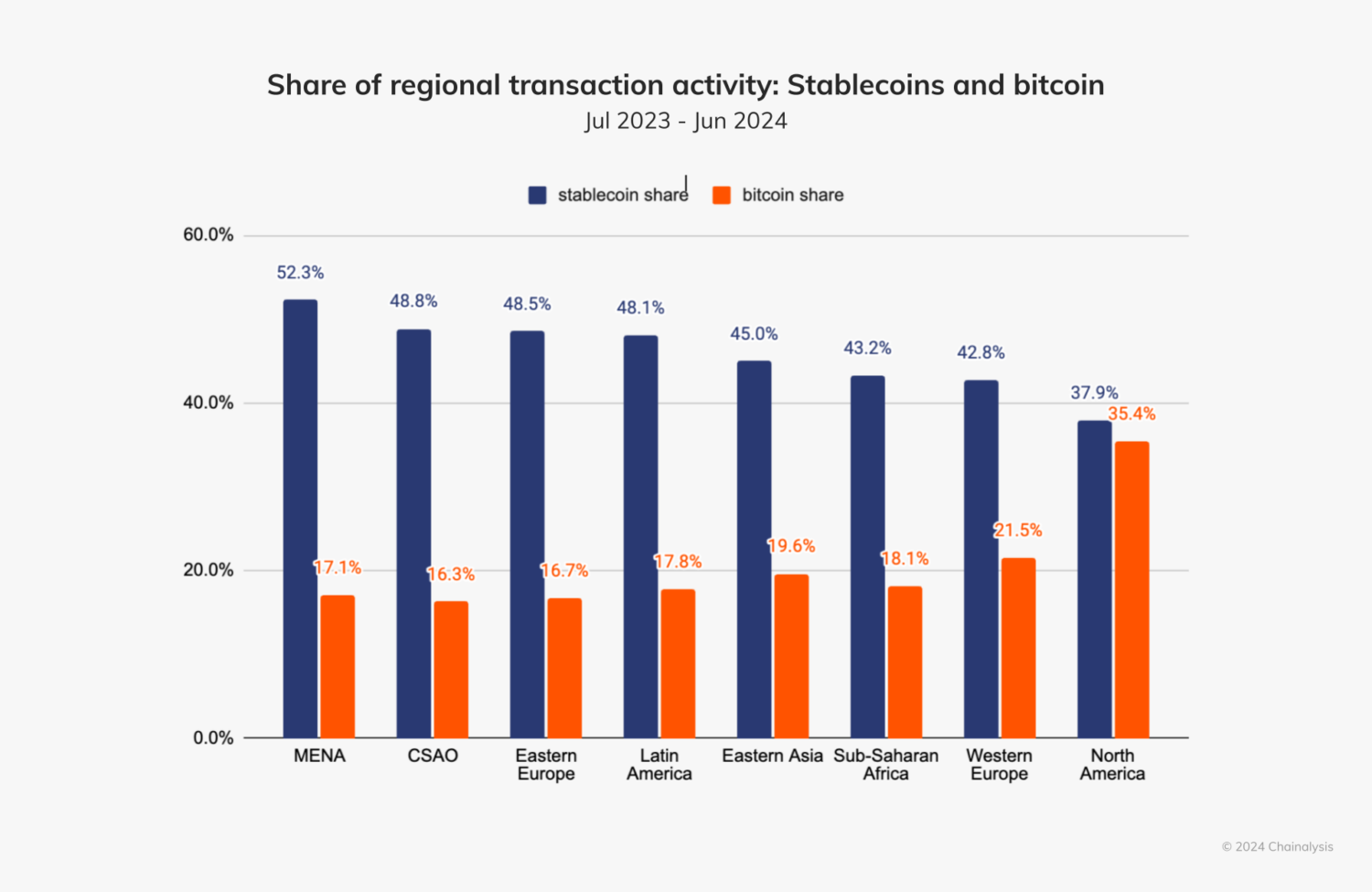

The stablecoin market has matured significantly throughout the world, overtaking BTC as a preferred asset for everyday transactions, as we see below.

Regions like Latin America and Sub-Saharan Africa are embracing stablecoins as a hedge against local monetary instability, offering a more reliable means of transacting and preserving value. In these regions, retail adoption of stablecoins is largely driven by their practicality for low-cost remittances, secure savings in regions with volatile currencies, and accessibility to DeFi services like lending and staking.

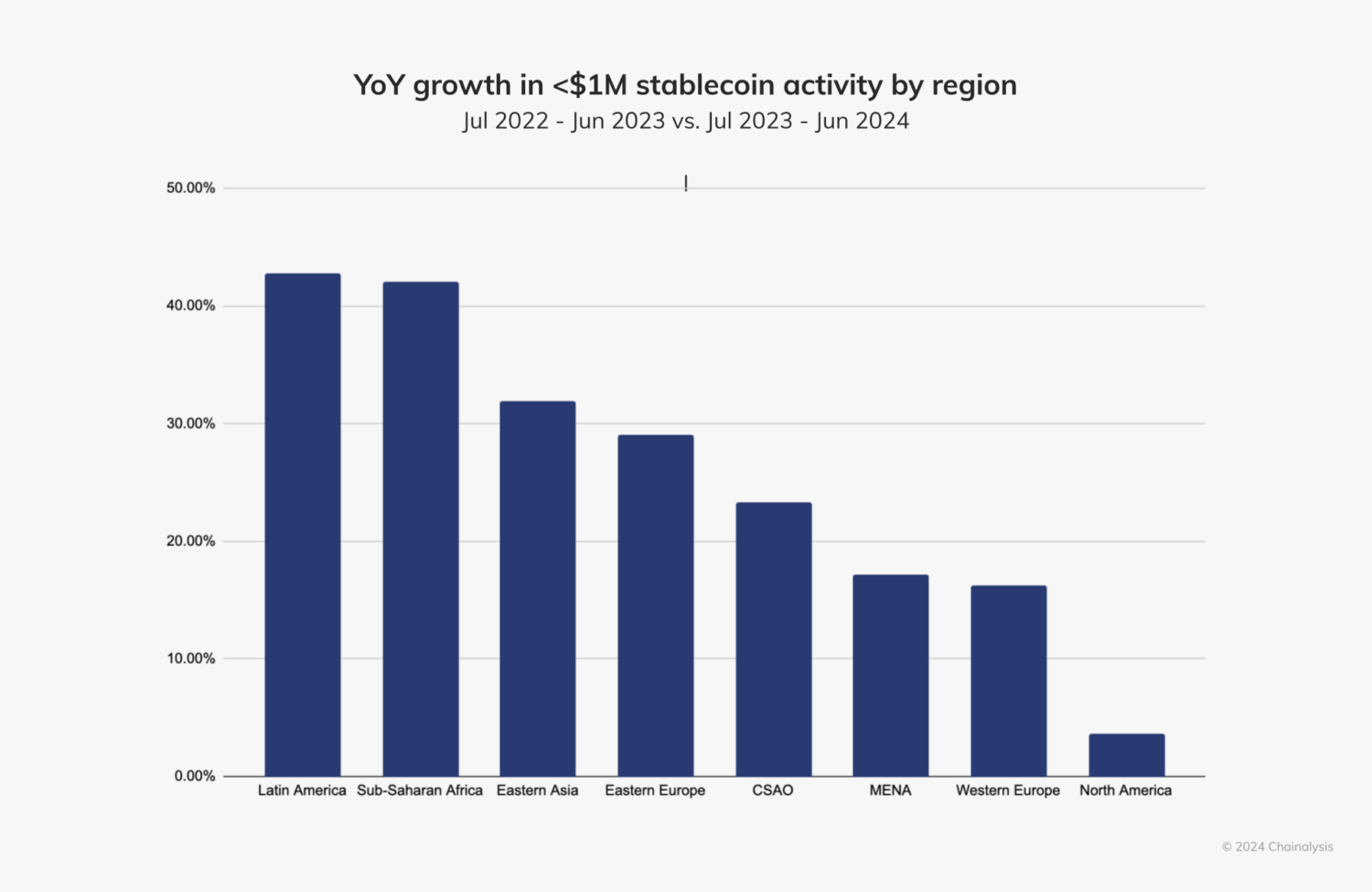

While stablecoins are gaining traction among institutions, much of their growth is fueled by transfers under $1 million — our benchmark for non-institutional activity — which we study in our annual Geography of Cryptocurrency report. Below, we examined the growth of retail and professional-sized stablecoin transfers from July 2023 to June 2024, compared to the same period of the previous year.

Latin America and Sub-Saharan Africa are the fastest growing regions for retail and professional-sized stablecoin transfers, with year-over-year (YoY) growth exceeding 40%. Eastern Asia and Eastern Europe follow closely, with 32% and 29% YoY growth respectively.

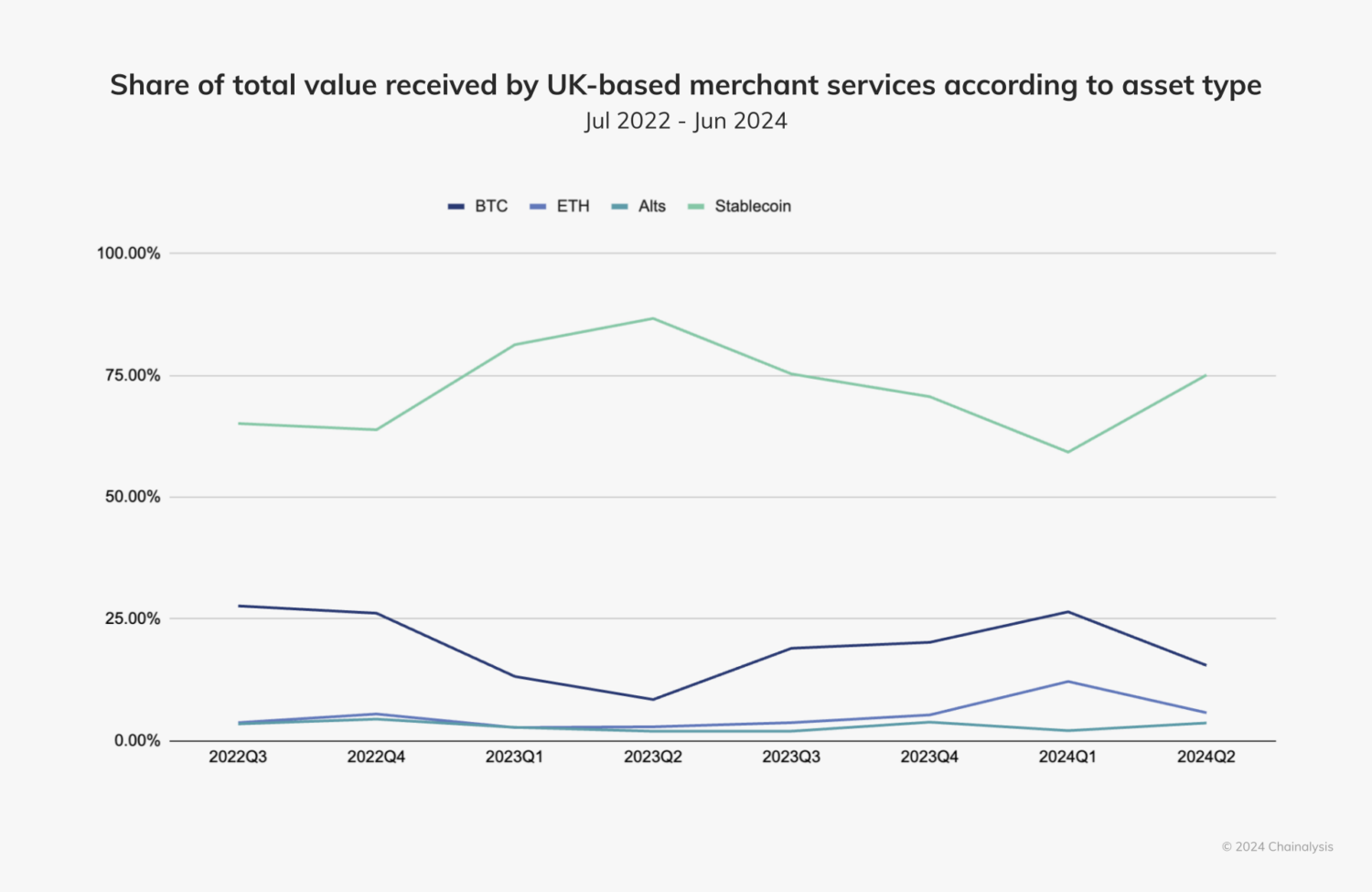

Meanwhile, markets like North America and Western Europe have seen meaningful, but slower growth of retail stablecoin activity, likely due to robust native financial infrastructure, although institutional investors in these regions increasingly adopt stablecoins for liquidity management, settlements, and entry into cryptocurrency. Notably, Western Europe is home to the second-largest merchant service market globally, with the UK leading the region’s growth at 58.4% YoY. Stablecoins dominate these services, consistently representing 60-80% of the market share each quarter, as we see below.

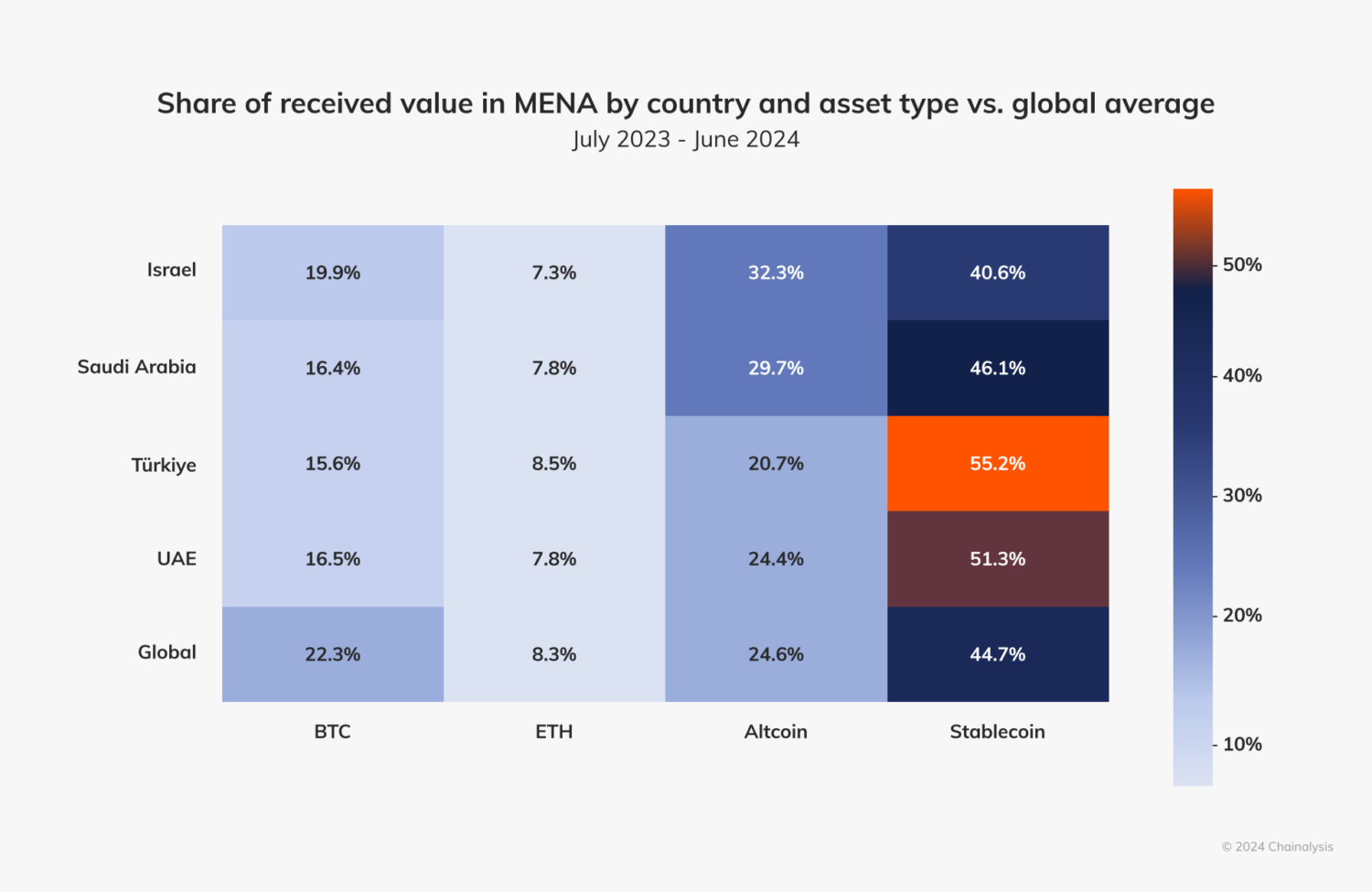

Across the Middle East and North Africa, stablecoins and altcoins are capturing a larger share of the market, surpassing traditionally dominant assets like BTC and ETH, particularly in Türkiye, Saudi Arabia, and the UAE.

Notably, Türkiye also leads the world in stablecoin trading volume as a percentage of GDP by a significant margin.

In Eastern Asia, Hong Kong is seeing a flurry of interest from potential issuers amid the launch of its stablecoin sandbox. The upcoming implementation of stablecoin regulation will pave the way for stablecoins to be listed for retail trading, which will likely provide a tailwind to Hong Kong’s web3 ambitions.

In Central & Southern Asia and Oceania, stablecoins are widely used for cross-border trade and remittances, bypassing traditional banking challenges. Countries like Singapore have bolstered stablecoin confidence through regulatory frameworks, making stablecoins a key tool for both retail and institutional users.

Stablecoin policy and regulation across the world

Stablecoins have become a priority for regulators worldwide due to their rapid adoption and growing role in the global financial system in a variety of use cases. Governments and regulatory bodies are grappling with the challenge of creating frameworks that encourage innovation while ensuring consumer protection, financial stability, and compliance with anti-money laundering and counter-terrorism financing (AML/CFT) standards.

European Union (EU)

The European Union (EU) has introduced the Markets in Crypto-Assets Regulation (MiCA) to create a unified framework for crypto-assets within the EU for both issuers and service providers of crypto-assets, including stablecoins. MiCA represents a significant shift from AML-focused regulation (introduced by the 5th Anti-Money-Laundering Directive) to a comprehensive regulatory framework that establishes prudential and conduct obligations. MiCA focuses on enhancing consumer protection, and ensuring market integrity and financial stability. MiCA’s stablecoin framework has been in effect since June 30, 2024, while the regulations governing crypto-asset service providers (CASPs) will come into force on December 20, 2024. Although MiCA is a European regulation, applicable across all 27 EU member states, the responsibility for licensing and supervising issuers and CASPs lies with the respective national authorities.

MiCA establishes two different types of stablecoins: (i) asset-referenced tokens (ARTs), which purport to maintain a stable value by referencing another value or right or a combination thereof, including one or more official currencies, commodities, or crypto-assets, and; (ii) e-money tokens (EMTs) which purport to maintain a stable value by referencing the value of one official currency, such as the EUR or USD. Issuers of ARTs and EMTs within the EU must obtain respective MiCA licenses, including publishing detailed whitepapers, and adhering to strict rules on governance, reserve asset management, and redemption rights.

EMTs — considered both a crypto-asset and funds — function as a means of payment, whereas ARTs are regarded as a means of exchange requiring issuers to report transactional activity in more detail. Furthermore, ARTs can be subject to issuance restrictions. Major stablecoins, so-called ‘significant’ stablecoins, face tighter regulations, including higher capital requirements and reserve asset obligations, with direct supervision by the European Banking Authority (EBA) rather than with national regulators. While MiCA has the potential to become a global standard, challenges like unclear national implementation and overlapping classifications call attention to the need for additional guidance to ensure smooth implementation and adoption.

Singapore

The Monetary Authority of Singapore (MAS) has finalized the country’s stablecoin regulatory framework, focusing on single-currency stablecoins (SCS) pegged to the Singapore Dollar or any G10 currency in circulation in Singapore. The framework sets on value stability, capital adequacy, redemptions and disclosures, to ensure prudential soundness and consumer protection. Stablecoin issuers that fulfill all requirements under the framework can apply to be recognised as “MAS-regulated stablecoins”.

Hong Kong

Hong Kong operates as a Special Administrative Region of China with distinct legal and regulatory frameworks that set it apart from Mainland China. This separation has allowed Hong Kong to foster progressive regulatory policy surrounding stablecoins and other crypto assets. The Hong Kong Monetary Authority (HKMA) has developed a regulatory framework for stablecoin issuers, acknowledging the rapidly evolving digital money landscape. Even as legislation is being finalised, the HKMA has launched a sandbox enabling industry stakeholders with compelling use cases to develop and test their business models, fostering two-way discussions on regulation and risk management. Three projects were accepted into the sandbox in July 2024.

Japan

Japan was one of the first countries in the world to establish a regulatory framework for stablecoins. The framework, which has a strong focus on stability and oversight, allowed banks, trust companies, and fund transfer service providers to issue fiat-backed stablecoins under strict reserve requirements. While major corporations like MUFG are reportedly exploring stablecoin opportunities, the market is still nascent today, with no stablecoins listed on local exchanges or Electronic Payment Instrument Service Provider (EPISP) registrations. More recently, the Japan Financial Services Agency is reviewing stablecoin rules taking into consideration international experience.

United States

Stablecoin regulation in the United States remains a work in progress, marked by significant uncertainty and debate. While stablecoins like USDC and USDT have seen widespread adoption for payments and financial services, the lack of a comprehensive regulatory framework has created challenges for issuers and users alike. Efforts to address this include proposed legislation, such as the stablecoin bill advanced by the House Financial Services Committee in 2023, which seeks to establish clear rules for issuers regarding reserves, transparency, and anti-money laundering (AML) compliance.

Major stablecoin issuers

While there are hundreds of stablecoins in circulation, the majority are issued by Tether, followed by Circle. Other issuers, while smaller in market share, are actively changing the landscape of stablecoins.

Tether (UDST)

Tether (USDT) is the largest stablecoin by market cap, and accounts for the majority of stablecoin supply, offering liquidity across numerous blockchains. Tether has faced scrutiny over its reserves and financial transparency, but the company points to audits and market stress tests to demonstrate its robust position. Tether holds nearly $100 billion in US Treasury bills, with most of its assets managed by Cantor Fitzgerald, making it comparable to major countries in terms of reserve assets. Tether continues expanding its offerings, including Emirati Dirham-backed tokens and gold-backed stablecoins, with a focus on markets where these assets provide tangible value.

Circle (USDC)

Circle issues USDC, which is the second-largest stablecoin by market cap. USDC is known for its transparency, with weekly attestations of its reserves. The reserves are held in cash and short-duration U.S. government treasuries, providing a high level of transparency and assurance to users.

Paxos

Paxos issues Pax Dollar (USDP) and provides the infrastructure for PayPal’s stablecoin, PayPal USD (PYUSD) and other stablecoin projects across the world. Paxos emphasizes transparency and trust, adhering to guidelines for portfolio management and publishing monthly attestation reports to verify reserves.

PayPal (PYUSD)

PayPal has entered the stablecoin market with PayPal USD (PYUSD), issued in collaboration with Paxos. PYUSD is designed for payments and is backed by reserves managed by Paxos, with regular transparency reports available to the public.

Use cases for stablecoins

Once used primarily for crypto trading, stablecoins have become a versatile tool for every day use cases, powering a broad range of utility for the crypto native ecosystem and TradFi alike.

On-ramp to DeFi

Stablecoins are the backbone of many DeFi protocols, facilitating lending, borrowing, and yield farming. Their lack of price fluctuation makes them ideal for liquidity pools, where they reduce impermanent loss and maintain the efficiency of decentralized exchanges (DEXs). Stablecoins also enable global access to financial services, empowering users in economically unstable regions to participate in DeFi markets without exposure to local currency volatility.

Payments and peer-to-peer (P2P) transactions

Stablecoins are increasingly used for everyday payments and P2P transfers. Their ability to process transactions quickly and cost-effectively, often with minimal fees compared to traditional banking systems, makes them an attractive option for users. In P2P transactions, stablecoins provide a simple and secure way for individuals to exchange value without intermediaries. This is particularly valuable in regions with limited access to reliable banking systems.

Cross-border transactions and remittances

Cross-border payments and remittances are among the most transformative use cases for stablecoins. They provide a faster and cheaper alternative to traditional remittance services, which often involve high fees and slow processing times. Migrant workers — who are often un- and underbanked — use stablecoins to send money home to their families and businesses are using them to settle international invoices. Stablecoins provide a solution that bypasses the inefficiencies of legacy financial systems, bolstering financial inclusion and reducing friction in cross-border transactions.

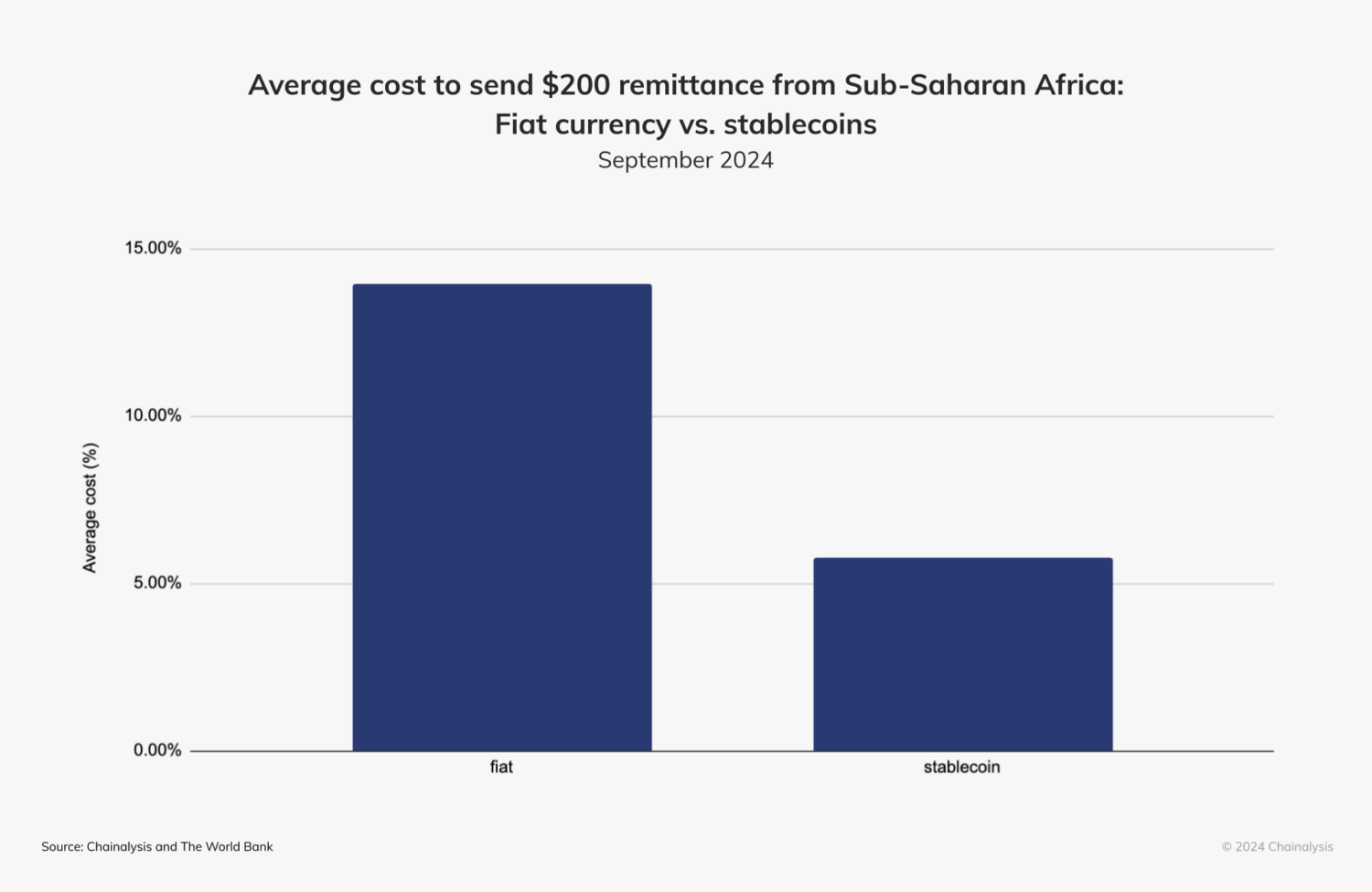

For example, sending a $200 remittance from Sub-Saharan Africa is about 60% cheaper using stablecoins compared to traditional fiat-based remittance methods, as shown below.1

Foreign exchange (FX) and trade finance

For foreign exchange and trade finance, stablecoins enable businesses to transact in a globally accepted digital currency, reducing reliance on intermediaries and mitigating risks associated with fluctuating exchange rates. Stablecoins simplify transactions for importers and exporters, providing a stable and transparent medium for international trade, particularly in regions with limited access to foreign currency.

Store of value among economic instability or inflation

Stablecoins have become a preferred store of value in regions facing economic instability or high inflation. By pegging their value to assets like the USD, stablecoins offer individuals and businesses a way to preserve purchasing power and shield their assets from the volatility of local currencies. This use case has been particularly impactful in emerging markets where access to stable financial instruments is limited and a straightforward on-ramp to the USD is highly desired.

Stablecoins often trade at a premium in high-inflation regions, reflecting users’ willingness to pay for stability and faster money movement. Currency instability in emerging markets leads to significant GDP losses over time, further driving the demand for stablecoins.

Illicit activity in the stablecoin ecosystem

While stablecoins have gained significant traction for their legitimate use cases, they have also been exploited by high-risk and illicit actors for various illegal activities. Their stability and global accessibility make them attractive tools for bad actors seeking to bypass financial controls and avoid detection — although the inherent transparency and traceability of blockchain often makes this a poor choice.

Although we estimate less than 1% of on-chain transactions are illicit, stablecoins have been used in activities such as money laundering, fraud, and sanctions evasion. Due to their relatively high liquidity and acceptance across cryptocurrency exchanges, stablecoins can be used to transfer value quickly across borders without relying on traditional financial institutions.

Sanctions evasion using stablecoins

Sanctions evasion through stablecoins and other cryptocurrencies has gained prominence as countries like Russia explore alternatives to bypass Western financial restrictions. Entities in sanctioned regions might turn stablecoins to facilitate international trade or transfer funds to entities in non-sanctioned jurisdictions. These activities exploit the pseudonymous nature of blockchain transactions to obscure the origins of funds, often through complex networks of wallets and exchanges. While large-scale sanctions evasion remains challenging due to crypto market liquidity constraints and the transparency of blockchain transactions, smaller-scale activities, such as fund transfers by sanctioned entities and politically exposed persons, pose security and compliance risks.

How stablecoin issuers collaborate with law enforcement

Stablecoin issuers have stepped up their efforts to fight financial crime, supporting global law enforcement and regulatory investigations. Issuers like Tether work closely with global law enforcement agencies, financial crime units, and regulators like the Financial Crimes Enforcement Network (FinCEN) using Chainalysis to monitor transactions in real-time and identify suspicious activity. Most centralized stablecoin issuers also have the power to freeze or permanently delete or “burn” tokens in wallets linked to confirmed criminal activities, stopping illegal transactions and helping recover stolen funds.

Which stablecoin issuers can burn and freeze coins?

Stablecoins issued by a centralized service like USDC (Circle), USDT (Tether), BUSD (Paxos), and TUSD (Techteryx) can be frozen or burned by their issuers to comply with regulations or prevent illicit activities. In contrast, decentralized stablecoins such as DAI (MakerDAO), FRAX (Frax Finance), and LUSD (Liquity) are managed by protocols and smart contracts, making them resistant to freezing or burning by any centralized authority. The balance between compliance and user autonomy is an important consideration for decentralized technologies.

The role of blockchain intelligence

While stablecoins offer significant benefits to the financial system, addressing their misuse by illicit actors is of the utmost importance. Chainalysis plays a critical role in proactively assisting in the detection and prevention of illicit activities involving stablecoins. With real-time monitoring, Chainalysis can identify frozen or burned assets, trace the flow of funds, and map networks of wallets associated with high-risk actors across various blockchains.

By collaborating with stablecoin issuers, regulators, law enforcement and other ecosystem participants, Chainalysis helps ensure that stablecoins are used responsibly and not exploited for criminal purposes, reinforcing trust in the ecosystem and allowing innovators to confidently build on-chain.

The future of stablecoins

Stablecoins not only represent a critical intersection between blockchain and legacy financial systems, but also open up new avenues for economic participation. Adoption continues to grow across regions and industries, supported by regulatory advancements that aim to provide clarity and build trust among users and institutions. As frameworks like Europe’s MiCA and guidelines in markets such as Singapore and Japan take shape, stablecoins are set to gain further legitimacy and integration into mainstream financial systems.

The future of stablecoins is not without challenges. Regulatory uncertainty in key markets, exploitation by illicit actors, and questions around reserve transparency are always pertinent, which could undermine market confidence and hinder broader adoption if not addressed effectively. On the other hand, stablecoins offer immense opportunities for financial inclusion, particularly in underserved regions, and are actively revolutionizing payments, remittances, and trade finance by reducing costs and increasing speed. The role of stablecoins in creating new financial products and streamlining cross-border commerce further speaks to their transformative potential.

With ongoing advancements in regulation and technology, stablecoins have the potential to unlock new opportunities, bridging gaps between economies and enabling greater global financial connectivity. Their continued evolution will play a central role in defining the future of crypto and TradFi alike.

1 The remittance price for fiat currency, sourced from the World Bank for 2024 Q1, is used to represent the average cost for senders, which covers banks, money transfer operators (MTOS), mobile operators, and post offices. For stablecoin remittances, the total cost was calculated to include exchange deposit fees, trading fees, transfer fees, and on-chain transactions on regional exchanges in Sub-Saharan Africa. Both methods account for the FX margin, which reflects the percentage difference between the remittance service provider’s exchange rate and the interbank rate. For stablecoins, the FX margin was calculated using the price difference between the close price on September 18th and the mid-market exchange rate on September 19th at 12:00 AM UTC, as provided by Wise.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.